Inheritance Tax Planning: 2026 Allowances and Exemptions Guide

Inheritance tax remains one of the most significant concerns for individuals and families with property, savings or investment assets. Despite widespread awareness of inheritance tax, many estates still pay more than necessary due to late planning, misunderstandings about allowances, or reliance on outdated information.

As we approach 2026, inheritance tax planning continues to play a crucial role in protecting estate value and ensuring assets are passed on efficiently. While allowances and exemptions are set by legislation and subject to change, the underlying framework for inheritance tax remains consistent.

This guide explains the inheritance tax allowances and exemptions expected to apply in 2026, how they work in practice, and why professional inheritance tax planning is often critical.

What Is Inheritance Tax?

Inheritance tax is charged on the value of an individual’s estate when they die, to the extent that it exceeds available allowances and exemptions. The standard rate of inheritance tax is 40 per cent on the taxable portion of the estate.

An estate includes property, savings, investments, personal possessions and certain lifetime gifts. Inheritance tax is not payable on every estate, but rising property values mean more families are now affected.

Inheritance tax planning involves structuring financial affairs lawfully to reduce tax exposure while ensuring assets pass according to personal wishes.

Inheritance Tax Allowances in 2026

The Nil-Rate Band

The nil-rate band allows part of an estate to pass free of inheritance tax. This threshold has been frozen for several years and is expected to remain unchanged through 2026 unless legislation is amended.

Any estate value above the available nil-rate band may be subject to inheritance tax. For estates involving property, this threshold is often exceeded quickly.

Effective inheritance tax planning frequently focuses on maximising use of the nil-rate band across spouses and generations.

The Residence Nil-Rate Band

The residence nil-rate band provides an additional allowance when a qualifying residential property is passed to direct descendants, such as children or grandchildren.

This allowance is subject to strict conditions and can taper away for higher-value estates. Incorrect Will drafting or estate structure can result in the allowance being lost.

Professional advice is often required to ensure the residence nil-rate band is preserved and applied correctly.

Key Inheritance Tax Exemptions

Spouse and Civil Partner Exemption

Transfers between spouses and civil partners are generally exempt from inheritance tax, both during lifetime and on death.

Unused nil-rate bands and residence nil-rate bands can often be transferred to the surviving spouse, potentially doubling available allowances on second death, provided correct records are maintained.

Charity Exemption

Gifts to registered UK charities are exempt from inheritance tax. In some cases, charitable gifts can also reduce the inheritance tax rate applied to the remainder of the estate.

This exemption can be an effective planning tool but must be structured carefully to achieve the intended outcome.

Lifetime Gifts and the Seven-Year Rule

Lifetime gifts can reduce the value of an estate for inheritance tax purposes. Certain gifts fall outside the estate entirely if the individual survives seven years from the date of the gift.

This is one of the most misunderstood areas of inheritance tax. Poor documentation or incorrect assumptions can result in unexpected tax liabilities.

HMRC frequently reviews lifetime gifts, making accurate records and professional advice essential.

Annual and Small Gift Exemptions

Smaller exemptions apply to annual gifting and small individual gifts. While modest, these exemptions can support long-term planning when used consistently.

Gifts made from surplus income may also be exempt, provided strict conditions are met and properly documented.

Common Inheritance Tax Planning Mistakes

A frequent mistake is leaving planning too late. Inheritance tax planning is most effective when started early, allowing time for lifetime gifts and structured arrangements to take effect.

Relying on outdated Wills or informal advice is another common issue. Changes in legislation, asset values or family circumstances can quickly undermine previous planning.

Incorrect assumptions about exemptions, particularly those relating to property and lifetime gifts, often lead to unnecessary tax exposure.

Practical Inheritance Tax Planning Strategies

Early and Ongoing Planning

Inheritance tax planning should be reviewed regularly. Early planning provides flexibility and a wider range of options to reduce potential liability.

Structured Lifetime Gifting

Planned and documented gifting can reduce estate value while supporting family members during lifetime. Professional advice ensures compliance and proper record-keeping.

Will Structuring

A professionally drafted Will is central to inheritance tax planning. It helps ensure allowances and exemptions are used efficiently and assets pass in line with personal and tax objectives.

Review of Asset Ownership

The way assets are owned can significantly affect inheritance tax outcomes. Joint ownership, trusts and beneficiary nominations all require careful consideration.

The Importance of Professional Inheritance Tax Planning

Inheritance tax rules are complex, and mistakes can be costly. HMRC scrutiny has increased, particularly around valuations, lifetime gifts and exemption claims.

Professional inheritance tax planning provides clarity, compliance and reassurance. For many families, it results in substantial tax savings and reduced administrative burden for executors.

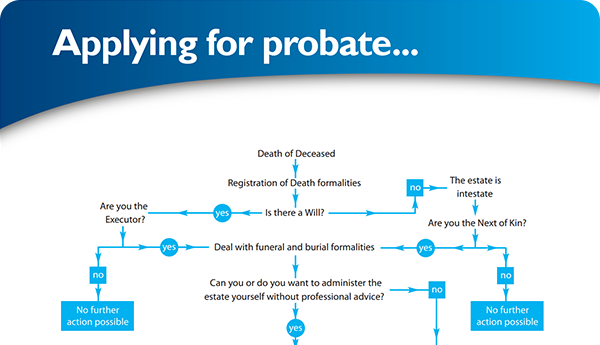

Inheritance Tax Planning and Probate

Inheritance tax planning does not end at death. Executors must apply allowances and exemptions correctly during probate, and errors can lead to delays, penalties and disputes.

Professional support helps ensure planning is implemented accurately at every stage

Conclusion

Inheritance tax planning remains essential in 2026 for individuals whose estates may exceed available allowances. Understanding allowances, exemptions and planning options can significantly affect the value passed to beneficiaries.

Professional inheritance tax planning helps manage risk, ensure compliance and reduce liabilities wherever possible.

If you are concerned about inheritance tax exposure, early professional advice can provide clarity and long-term peace of mind.

Frequently Asked Questions: Inheritance Tax Planning

- What is the inheritance tax allowance in 2026?

The nil-rate band is expected to remain unchanged unless legislation changes. - What is the residence nil-rate band?

An additional allowance for qualifying homes passed to direct descendants. - Are spouses exempt from inheritance tax?

Yes. Transfers between spouses and civil partners are generally exempt. - Are gifts to charity exempt?

Yes. Gifts to registered charities are exempt and may reduce tax rates. - How do lifetime gifts affect inheritance tax?

Some gifts fall outside the estate if the donor survives seven years. - What is the biggest planning mistake?

Leaving planning too late or relying on outdated advice. - Is professional advice necessary?

In most cases, professional advice helps maximise allowances and ensure compliance. - Can inheritance tax planning reduce probate delays?

Yes. Clear planning and documentation reduce HMRC queries. - Does inheritance tax apply to all estates?

No. It only applies where estate value exceeds available allowances. - When should planning start?

As early as possible to maximise flexibility and effectiveness.

Share This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×